After eight years of researching Salesforce talent trends and tracking the evolving partner ecosystem, we’ve learned to expect the unexpected. 2025 was no exception. Fueled by renewed demand and the AI revolution reshaping roles and skills, this year marked a modest rebound and ongoing transformation across the Salesforce ecosystem.

Following two years of steep declines, global demand for Salesforce talent has begun to grow again. It’s an encouraging sign, though optimism across the ecosystem remains cautious.

Beneath that recovery lies a more complex story. Demand is shifting unevenly across regions, traditional roles are evolving, and the partner ecosystem continues to expand in new directions.

| Download the 2025 Salesforce Talent Ecosystem Report

Together, these shifts point to an ecosystem in transition: more global, more diverse, and more dynamic. To help navigate what’s next, our executive team shares their predictions for where the Salesforce talent market is headed in 2026 and beyond.

Nick Hamm, Chief Executive Officer

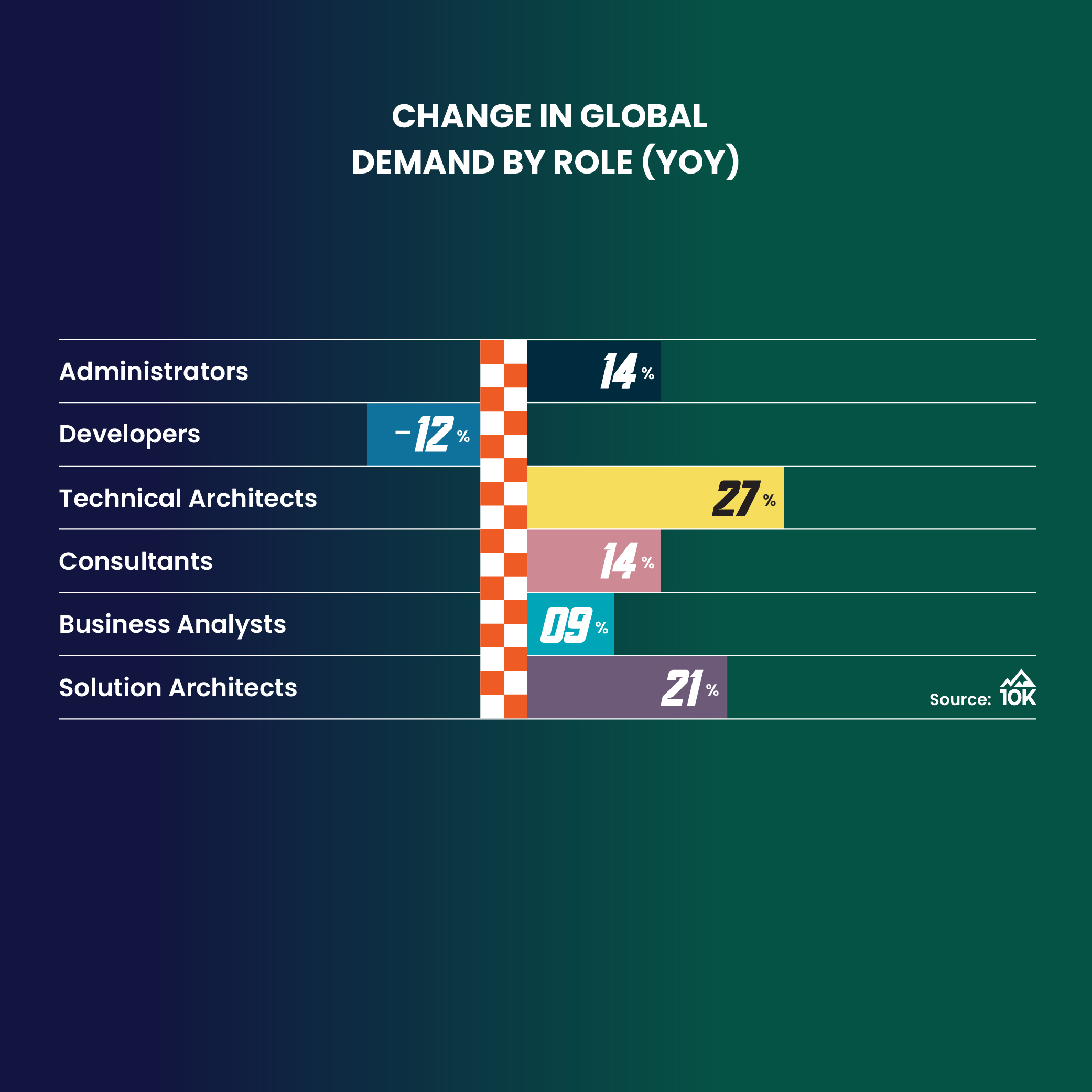

Key Takeaway: Demand for Salesforce talent rebounds after two years of decline (-37% in 2024, -46% in 2023), with global demand up 8% year over year. Although this marks a significant turnaround, Developer demand still declined 12%, signaling that we’re not completely out of the proverbial woods quite yet.

Prediction: The rebound in global demand for Salesforce talent will not be sustained across all roles and regions. While demand for architects and analysts will hold steady or rise, execution-focused roles such as Developers and Admins face an uncertain future.

The recovery is proving uneven across role types. Technical and Solution Architects, whose demand surged 27% and 21% respectively, are positioned to benefit from sustained growth as companies tackle complex integrations, remediate accumulated technical debt, and navigate AI-driven platform changes.

Meanwhile, execution-focused roles face structural headwinds that transcend typical economic cycles. Developers and Administrators (whose supply grew 20% and 47% while their demand contracted or barely recovered) are caught between automation pressures from AI coding assistants and an oversaturated talent pool. These forces suggest that demand volatility for these roles isn’t temporary turbulence but rather the new normal, as organizations increasingly ask “How much of this work can be automated or strategically consolidated?” rather than “How many of these professionals do we need?”

Matt Gvazdinskas, Chief Strategy Officer

Key Takeaway: Salesforce partner ecosystem hits a new high: The number of consulting partners surpassed 3,700, growing 25% year over year, the fastest rate since 2020.

Prediction: The Salesforce consulting partner ecosystem will continue to expand in 2026, though at a more sustainable pace. I expect 15–20% growth, reaching roughly 4,200–4,500 partners globally as the market matures and specialization deepens.

This growth continues a strong yet evolving story. After our 2023 report showed a 19% increase in partner firms, I predicted that growth would accelerate in 2024, which it did, reaching 3,000 partners and a 20% increase, the highest since 2020. I then projected that 2025 would bring even faster expansion, fueled by AI and industry-specific professional services, and that proved true once again: the 2025 report shows over 3,700 partners, a 25% year-over-year increase and the fastest growth in half a decade.

Looking ahead, expansion will be driven less by broad new market entry and more by specialization in AI, data, and industry-focused solutions, as firms double down on domain depth to meet customer demand for measurable outcomes. Emerging markets will remain a key source of new partners, while mature markets will see more consolidation and managed services. The ecosystem’s growth story isn’t over, but its rapid acceleration phase is beginning to level out as the market stabilizes.

Jared Miller, Chief Operations Officer

Key Takeaway: Demand for Technical and Solution Architects is outpacing all other roles.

Prediction: AI will narrow the gap in execution but widen the gap in design. Organizations that invest in architects, both technical and solution, by hiring, upskilling, and empowering them will surpass those that treat architecture as optional.

As AI takes on more of the repeatable build work such as scaffolding, configuration tweaks, and routine administration, what matters most isn’t working faster; it’s designing smarter.

The data highlights this divide clearly. Technical Architect demand grew 27% and Solution Architect demand grew 21% year over year, the highest increases across all Salesforce roles. Execution is getting faster, but the hardest problems like governance, data boundaries, integration patterns, and risk/cost control remain firmly in the hands of architects.

When architects are in the driver’s seat, the dynamics shift:

- Direction over velocity. AI accelerates delivery, but architects determine what to build, why, and how it fits together.

- Guardrails become assets. Prompt libraries, agent permissions, evaluation checks, and rollback plans are designed and owned by architecture.

- Outcomes over outputs. Success is measured in business KPIs and AI quality metrics, not just story points.

The bottom line: AI changes how work gets done, but architecture determines whether it gets done well. Organizations that invest in strong architectural leadership will evolve faster, deliver more value, and gain a lasting competitive edge.

Kristin Langlois, Chief People Officer

Key Takeaway: As AI continues to automate routine Salesforce tasks, organizations are placing greater value on roles that connect business strategy, data, and intelligent automation.

Prediction: Business Analysts will become the new backbone of the Salesforce ecosystem. The Admin role as we know it today will evolve into hybrid positions that blend analysis, automation, and data strategy.

In 2025, Business Analyst demand rebounded 9% and made up 14% of the overall job listings. Administrators remained the role with the fewest job postings for the third consecutive year, signaling the need for continued evolution.

The past two years, I encouraged Admins to deepen their technical expertise or explore complementary skills like business analysis. That shift is now underway. As AI automates more routine work, Business Analysts are emerging as the bridge between human decision-making and intelligent systems. I recommend Business Analysts continue strengthening their AI literacy, data fluency, and understanding of Salesforce automation. The future of Salesforce talent will belong to professionals who connect business goals and technology, defining how human judgment and AI work together to create impact.

Mike Martin, Chief Customer Officer

Key Takeaway: Technical Architects remain the rarest and fastest-rising role in the Salesforce ecosystem. They represent only 1% of global supply, with demand up 27% and supply up just 4% in 2025, the widest gap across all roles.

Prediction: The shortage of Salesforce Technical Architects will deepen in 2026 as demand accelerates and supply struggles to keep up.

Years of fragmented org growth without architectural oversight have left many Salesforce environments inefficient and hard to scale. As AI amplifies the need for clean, connected data, companies are finally prioritizing TA expertise to reduce technical debt and maximize ROI.

But the talent pipeline can’t keep up. Unlike Admins or Developers who can follow fast-track certification paths, TAs require years of deep technical experience, cross-cloud fluency, and strategic design acumen. This makes supply growth inherently slow.

Solution Architects are a potential feeder group, with 16% global supply growth, but the conversion rate to Technical Architect remains low. Emerging markets are helping ease the pressure, showing a 28% increase in TA supply. Because most Technical Architect work involves high-touch client collaboration, full offshoring isn’t always an option.

The result is a widening imbalance. Organizations will need hybrid strategies that combine near-term Technical Architect hiring with long-term talent development. Those that move too slowly risk being priced out or stuck with architectural blind spots that limit scalability and AI readiness.