It’s 2020 and things look a lot different than they did a year ago when we released our 2019 Salesforce Talent Ecosystem research report.

This time last year, Salesforce was gearing up to welcome 171,000 people to Dreamforce in San Francisco. The ecosystem was buzzing about IDC’s prediction that Salesforce could create more than 4.2 million jobs over the next five years, while our report highlighted the triple-digit talent growth already happening. We were going into offices, our kids were in school, and we had yet to truly experience Zoom fatigue.

Fast forward to today, and it’s a whole new world. We’re facing down a global pandemic that has cost more than a million lives worldwide, locking down our schools and economies. Unemployment is at a level not seen since the Great Depression. We’re all being forced to rethink how we learn, how we work, how we sell, how we buy, how we communicate, and how we connect. We’ve experienced so much change in such a short amount of time, and changes just keep piling up.

Yet we believe the old way of doing things is never coming back. Digital transformation has become an imperative, not a choice, and companies are doubling down on these efforts. That might be one of the few bright spots in 2020, certainly for those in the Salesforce ecosystem. Companies see Salesforce as a critical cog in their digital machine, which may explain why Salesforce’s quarterly revenue is up 28.9% YoY and their stock price is up nearly 50% YTD — even amidst a global recession.

This is the environment in which we conducted our third annual Salesforce Talent Ecosystem research, and we were anxious to see the impact these changes were having on the people and partners who rely on Salesforce for their business and their livelihood. The results were surprising.

I encourage you to download and read the full report. However, for those who want the cliff notes, here’s what we found:

Salesforce talent supply is still increasing but at a much slower pace.

Global supply of Salesforce talent grew 29% YoY in 2020, which is a healthy pace but significantly slower growth than last year’s 151% increase.

Some roles and regions performed better than others. While Salesforce Technical Architects saw the highest growth across all roles, growing 29% YoY, Salesforce Administrators grew the slowest at only 15% YoY. That’s in stark contrast to last year’s numbers which had Administrator roles growing 236% YoY.

Within established markets, North America experienced the slowest overall growth at 17% YoY across all roles. Europe’s supply growth was strongest at 49% YoY. South America saw the highest supply growth of all the markets at 53% YoY, however, that is substantially lower than the region’s 254% YoY supply growth in 2019.

Demand for Salesforce talent (except developers) declined significantly.

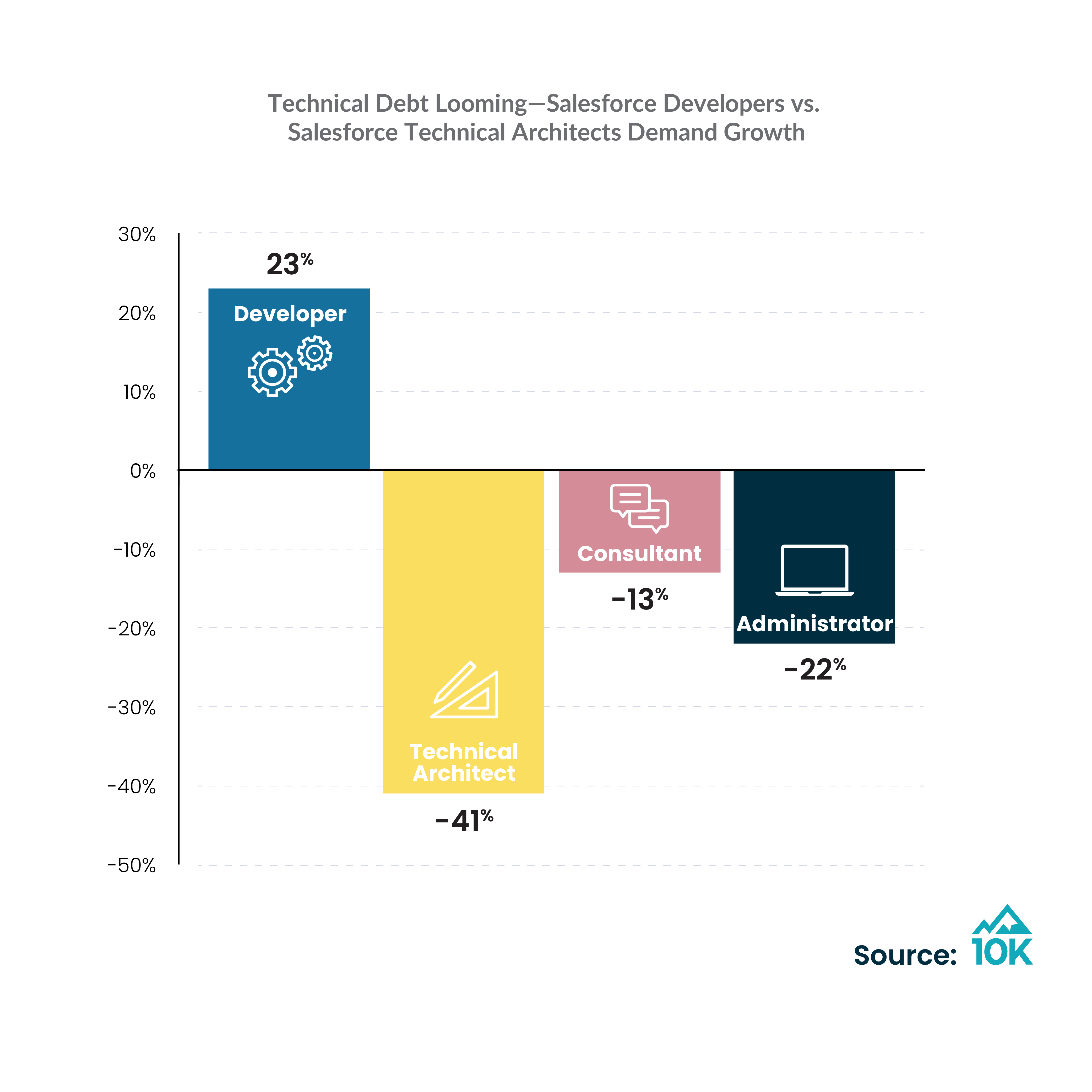

While we expected demand to drop, we were surprised at how much it declined. In an analysis of job listings across LinkedIn, Glassdoor, and Indeed, we found demand for Salesforce talent is down 7% YoY across all roles and regions. The only segment of talent that saw positive growth YoY was for Salesforce Developers.

Demand was down the most in North America (-27% YoY), although North America still has the highest number of job listings of all the regions.

With the talent supply increasing at a much slower rate than previous years and the demand dynamics changing, it will be interesting to see how these numbers impact Salesforce customers’ ability to execute on digital transformation initiatives throughout 2021 and beyond.

The Salesforce consulting partner ecosystem continues to grow.

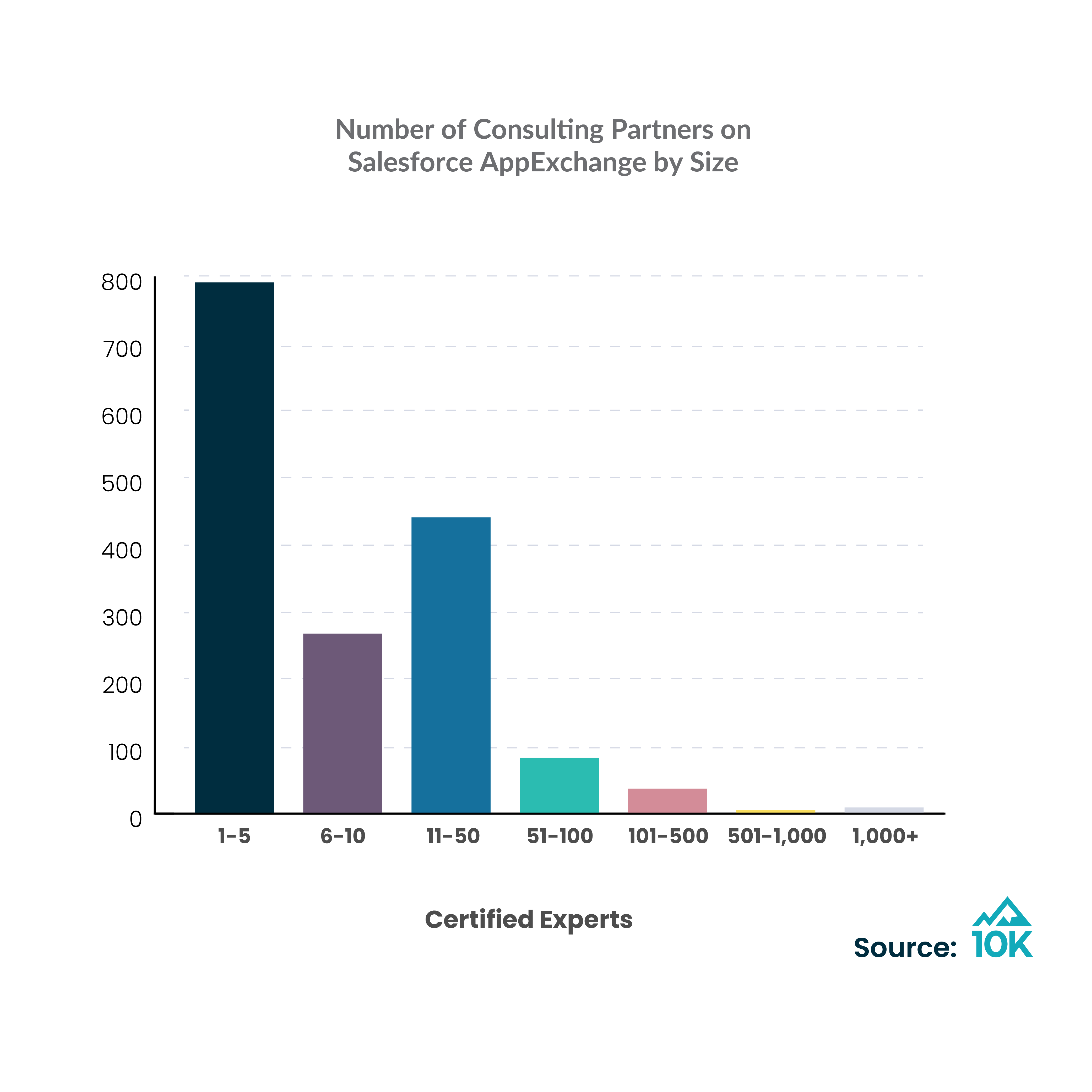

The consulting partner ecosystem is a good bellwether for the health of the broader talent ecosystem, and those numbers are looking good so far. As of September 2020, our independent AppExchange analysis shows consulting partner profiles growing 29% YoY to over 1600 listed consulting partners. That’s up compared to a growth rate of 23% in last year’s analysis.

We saw growth at both ends of the spectrum. The largest three consulting partners in the ecosystem (Accenture, Deloitte, Cognizant) each grew the number of certified experts they report to AppExchange by more than 25% YoY. However, the smallest partners listed on AppExchange (those with 1-5 certified consultants) still comprise nearly half of all registered partners. The growth of this segment of partners continues to accelerate, from 11% in 2019 to 27% in 2020.

We’re making progress on gender diversity, but there’s plenty of room to improve.

This is the third year we’ve analyzed gender diversity in the Salesforce talent ecosystem. Here’s the good news. We’re making progress. Our analysis of more than 6400 LinkedIn profiles in August 2020 shows that almost all roles and regions saw an increase in the concentration of female profiles over the previous time period. India saw the most progress across roles and Australia/New Zealand became the first market where female profiles surpassed male profiles in any role. Female Salesforce Administrator profiles in this region comprised 54% of the profiles we researched.

Here’s the bad news. The extreme lack of gender diversity among the higher-paying, more experienced Salesforce Technical Architect roles remains again this year. Males still account for nine out of ten Technical Architect roles within established markets.

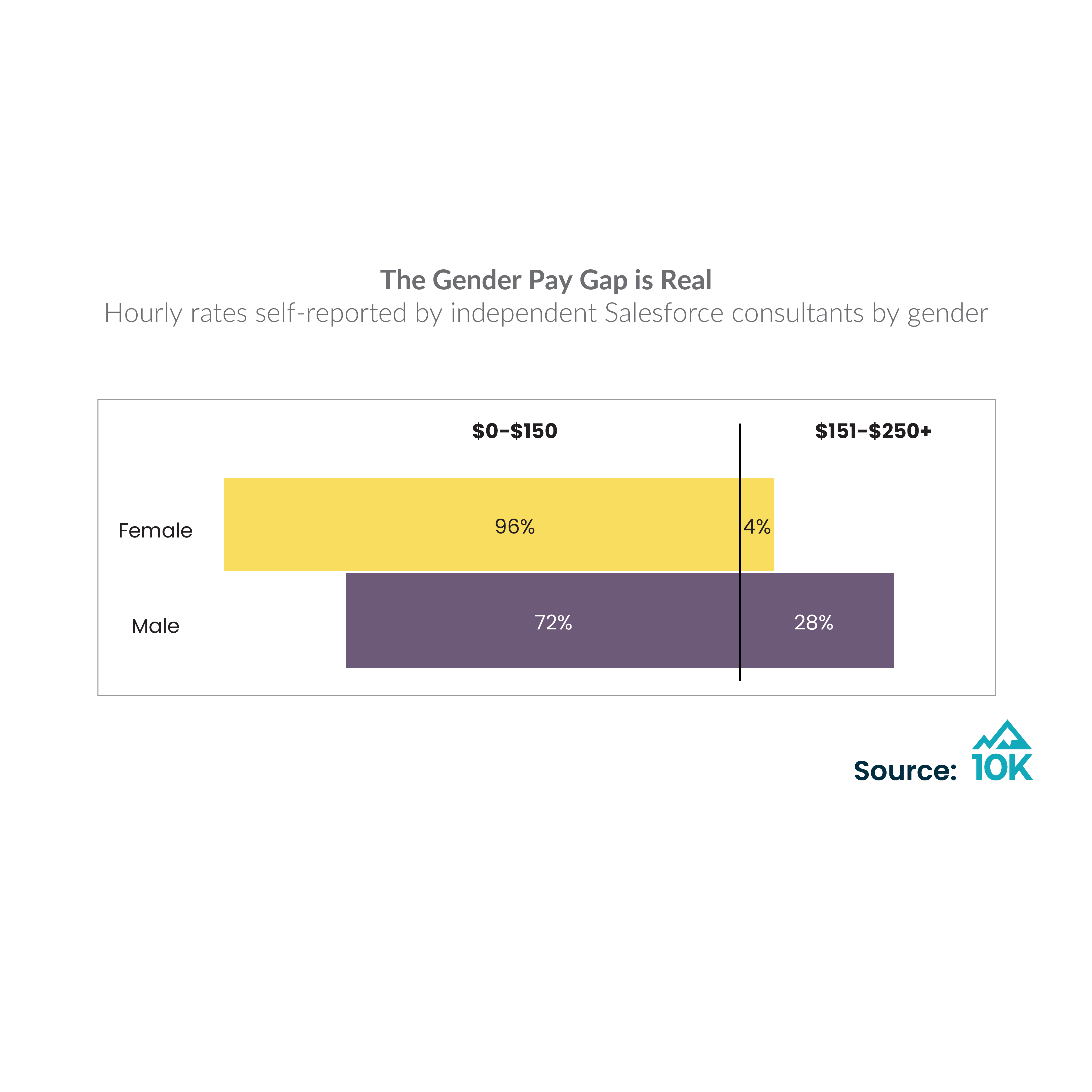

Here’s the really bad news. When we analyzed response data from our survey of 115 independent Salesforce consultants, it’s clear that pay disparity between genders is a big problem. In our survey, the hourly rates that independent consultants reported charging ran the gamut, with little correlation between roles or years of experience. However, when we cross-referenced hourly rates and gender we saw that more than a quarter of male respondents (28%) reported charging rates of over $150 an hour, whereas only 4% of female respondents reported charging rates in that same range. It’s clear that we as an ecosystem still have work to do here.

Independent consultants eye growth, even amidst a pandemic.

This year we put a spotlight on independents in the Salesforce ecosystem, a group that is close to our hearts. Our findings show they are some of the most experienced Salesforce experts available, and the majority of them not only plan to remain independent but also plan to also grow their business – even amidst the current environment.

More than 50% of independent Salesforce consultants said their long-term goal was to grow their own business, proof that it’s more than just a side hustle. Only 8% of respondents said they’d be very likely to return to a full-time position or larger firm.

When we asked this group how they’ve fared over this crazy year, we were pleased to see the response. Three-quarters of respondents said 2020 was either a better time than previous years to be independent or about the same as previous years. That’s pretty good. Especially for 2020.

Each year our team puts forth a tremendous effort to publish this report. I want to sincerely thank you for taking the time to read it and share it with your network. A special thanks to Michelle Swan and Megan Lynch Adler who are always instrumental in bringing this research to life – this report wouldn’t be possible without your guidance and creativity.